Quarterly Tax Payments 2025 Irs. Direct pay with bank account. Department of the treasury and internal revenue service (irs) are announcing key milestones reached as part of its ongoing transformation efforts made.

Generally, the internal revenue service (irs) requires you to make quarterly estimated tax payments for calendar year 2025 if both of the following apply: The irs noted, however, that payments on these returns are not eligible for the extra time because they were due last spring before the hurricane occurred.

2025 Quarterly Estimated Tax Due Dates Irs Ailey Anastasie, The irs noted, however, that payments on these returns are not eligible for the extra time because they were due last spring before the hurricane occurred. This guide will help you calculate quarterly estimated taxes for 2025 and beyond.

Irs Quarterly Estimated Tax Payments 2025 Ray Leisha, When should you make quarterly tax payments? You will need to create an irs online account before using this option.

Irs Quarterly Tax Payment 2025 Karyl Dolores, The irs collects estimated tax payments every quarter, and they should be paid as soon as income is collected. These dates don’t coincide with regular calendar quarters, though.

Irs 2025 Quarterly Tax Payment Schedule Tine Adriana, Making quarterly payments on time has more benefits than maintaining compliance with the irs. These are crucial to avoid.

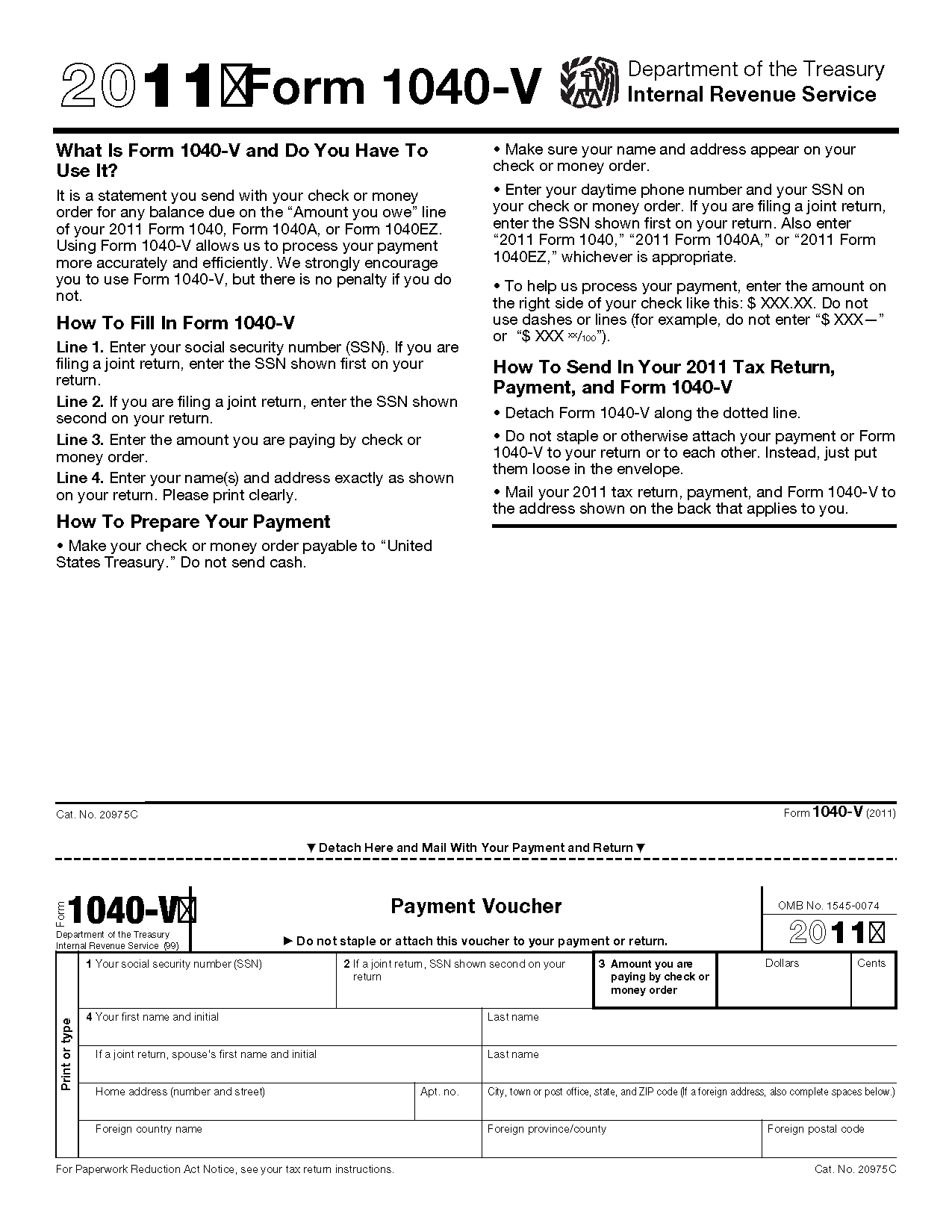

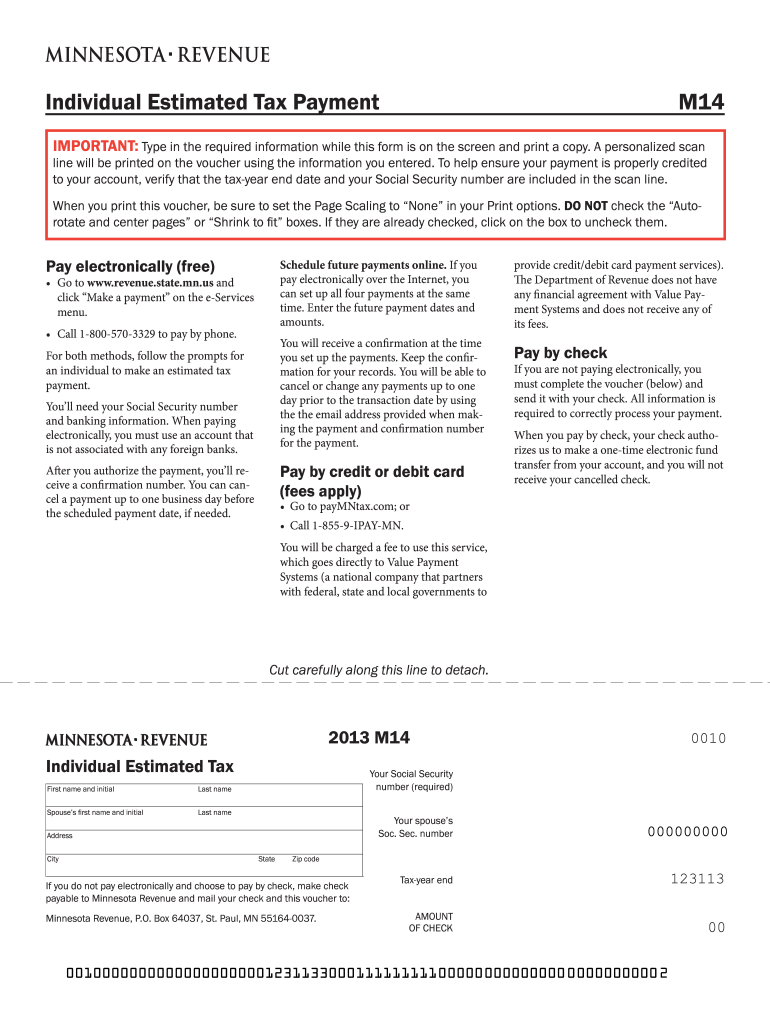

Irs Estimated Tax Payment Form 2025 Deana Estella, Quarterly estimated tax payments for the 2025 tax year are due april 15, june 17, and september 16. Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your checking or savings.

Irs Estimated Tax Payment Forms 2025 Genni Heloise, While the irs sets four main deadlines for estimated tax. The 2025 tax year requires quarterly estimated tax payments to cover your federal income and individual income tax liabilities.

2025 Quarterly Tax Payments Bessy Eleonora, Direct pay with bank account. Final payment due in january 2025.

Quarterly Tax Payments 2025 Forms Aurea Caressa, You'd expect to owe at least $1,000 in taxes for the current year (after subtracting refundable. Irs provides fifth quarterly update on transformation efforts, with commissioner danny werfel saying the agency is making “substantial progress.”.

2025 Quarterly Tax Payment Due Dates Suki Adelina, The 2025 tax year requires quarterly estimated tax payments to cover your federal income and individual income tax liabilities. On the other hand, regular calendar.

Irs Quarterly Estimated Tax Payments 2025 Form Reyna Kerianne, The 2025 tax year requires quarterly estimated tax payments to cover your federal income and individual income tax liabilities. Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your checking or savings.

Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your checking or savings.